Short answer? Yes. You can. However, there are some reasons why you may not want to:

-

It may end up being more costly.

I talk to many mental health professionals who do their mental health insurance billing without an EHR. Instead, they file at the insurance companies’ websites or possibly fax or even snail mail their claims. Often, they become so frustrated with the process that they end up hiring administrative staff to do it. However, a good behavioral health EHR can be a real game-changer. When the EHR has both efiling and ERA capabilities, both insurance billing and payment processes are simplified. Many therapists who try these types of EHRs find they can do insurance billing themselves, which saves staffing costs. Even those who want to maintain a staff can still pay less overall because the admins can complete their tasks more quickly with an EHR.

-

Filing at insurance sites takes more time and effort.

All insurance companies require pretty much the same patient data: name, address, DOB, etc. This is the same basic information we routinely collect on our intake forms. If we have an EHR, that data is already in our database. However, when the provider files with each insurance company separately, they have to reenter the data each time they need it.

There are some universal tasks almost all private practitioners in mental health have to do. These tasks hold true for those who bill insurance as well as those who are strictly private pay. For example, we all need some way to keep track of each day’s caseload: which clients we see, what we charge, what diagnoses and CPT codes we use. We need a way to collect and track client payments and to provide clients with receipts and/or statements. It’s nice to have a way to determine which clients still have outstanding balances after 30, 60 or 90 days. At tax time, we need a way to calculate our total income for the year, including payments from clients, insurance companies, or other payees. We also need some way to produce a client’s medical record or PHI (Protected Health Information) if we’re required to do so.

These routine tasks use much of the same data needed to efile. In other words, if you do your efiling at an insurance company’s website, you will have to copy the data FROM your client’s chart to the form on the insurance site. Then, once the insurance task is completed, the data from the insurance site must be copied back into the chart. This is the only way to maintain an up-to-date client record. If you use more than one type of software for some of the other tasks you do, data has to potentially be copied to several other programs. This can cause the problem to become compounded even more, requiring large chunks of time to keep it all straight.

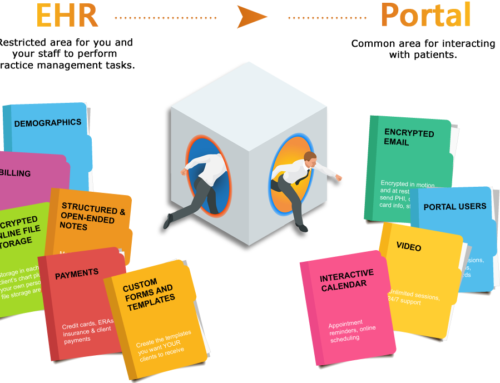

In contrast, when you have your own EHR, you enter the information once. There’s no duplication of efforts. PSYBooks takes the data you used to create your patient’s account and re-aggregates it behind the scenes to enable you to use the same data for your behavioral health insurance billing as well as other accounting tasks. Click a button and another configuration of the data allows you to create digital or paper statements or receipts, and to produce medical records for any client who needs them.

-

The learning curve at insurance company billing sites is greater.

Let’s say you have five clients and each of them has a different mental health insurance company. That means that to efile, you essentially have five different program interfaces to learn – not just one. That’s also five different URLs and logins to keep track of, five completely different systems to navigate. In contrast, when you have your own EHR, you learn it once and that’s it. You have a single URL. Furthermore, you login to a system that you use routinely so it stays fresh in your memory.

Also, most insurance company efiling systems are intended for all medical billing, not just mental health. Typically, large-scale medical billing systems like this are more difficult to learn than an EHR made just for behavioral health. Going back to the five insurance company example, we can now add that they’re probably not just any five billing interfaces. More than likely, they’re five fairly difficult and time-consuming billing interfaces to learn. Many people throw in the towel at this point, feeling that mental health insurance billing is just way over their heads – not realizing that there are simpler solutions.

-

Client records are scattered and may be difficult to retrieve.

When you’ve been in practice for at least a handful of years, you’ve probably noticed that clients change insurance companies. They get new jobs, their old jobs offer different plans, etc. If I see client Jane Doe on and off in my practice for ten years, she may changes insurance companies several times. If my routine is to efile at her insurance companies’ websites, Jane could end up with records scattered all over the place.

This practice can also make looking up her older records problematic. For example, perhaps Jane requests a copy of her medical record for three years ago when she saw me. If she’s no longer with the insurance company she had three years ago, I may or may not be able to retrieve those records for her. I don’t have any control over how the insurance company manages inactive clients. If you consider that in that same ten-year period, I may have encountered 500 clients – many of whom may have switched back and forth among the handful of insurance companies for which I’m a provider, the whole thing starts feeling a little chaotic and out of control.

In comparison, PSYBooks not only keeps all of your client records in one place, it also makes it easy to archive clients you’re no longer seeing and to reactivate them if they return for a few additional sessions. When a client changes insurance companies, making the old company inactive and assigning the new company is equally easy. And you ALWAYS have access to older records. They’re right there in your EHR when you need them. When you have your own EHR, unlike filing at insurance company websites, you maintain control of your own records.